Press Releases

AUTO1 Group Price Index: Used car prices drop at the start of 2026 as half of European dealers foresee further declines

Berlin, 28 January 2026

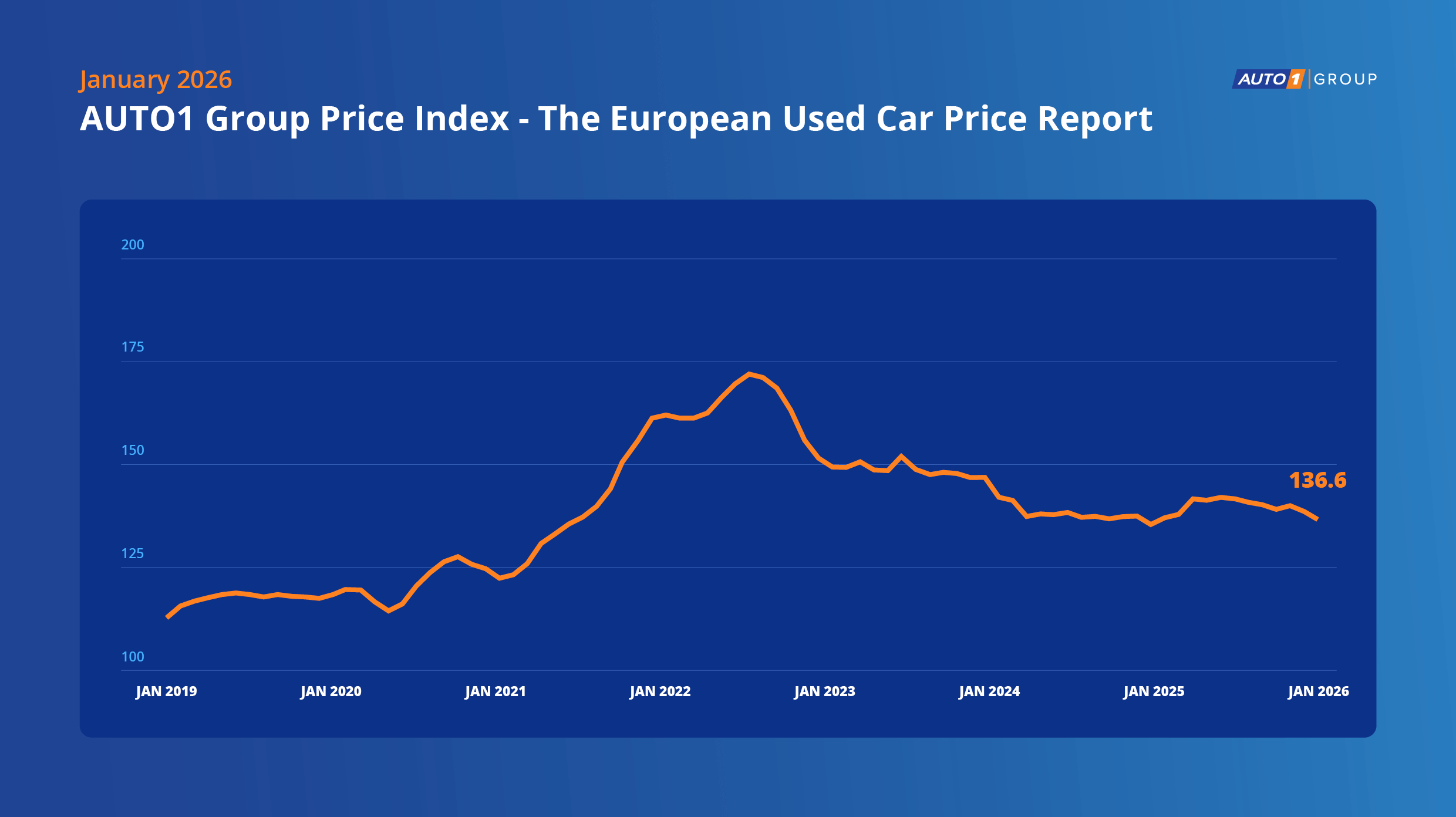

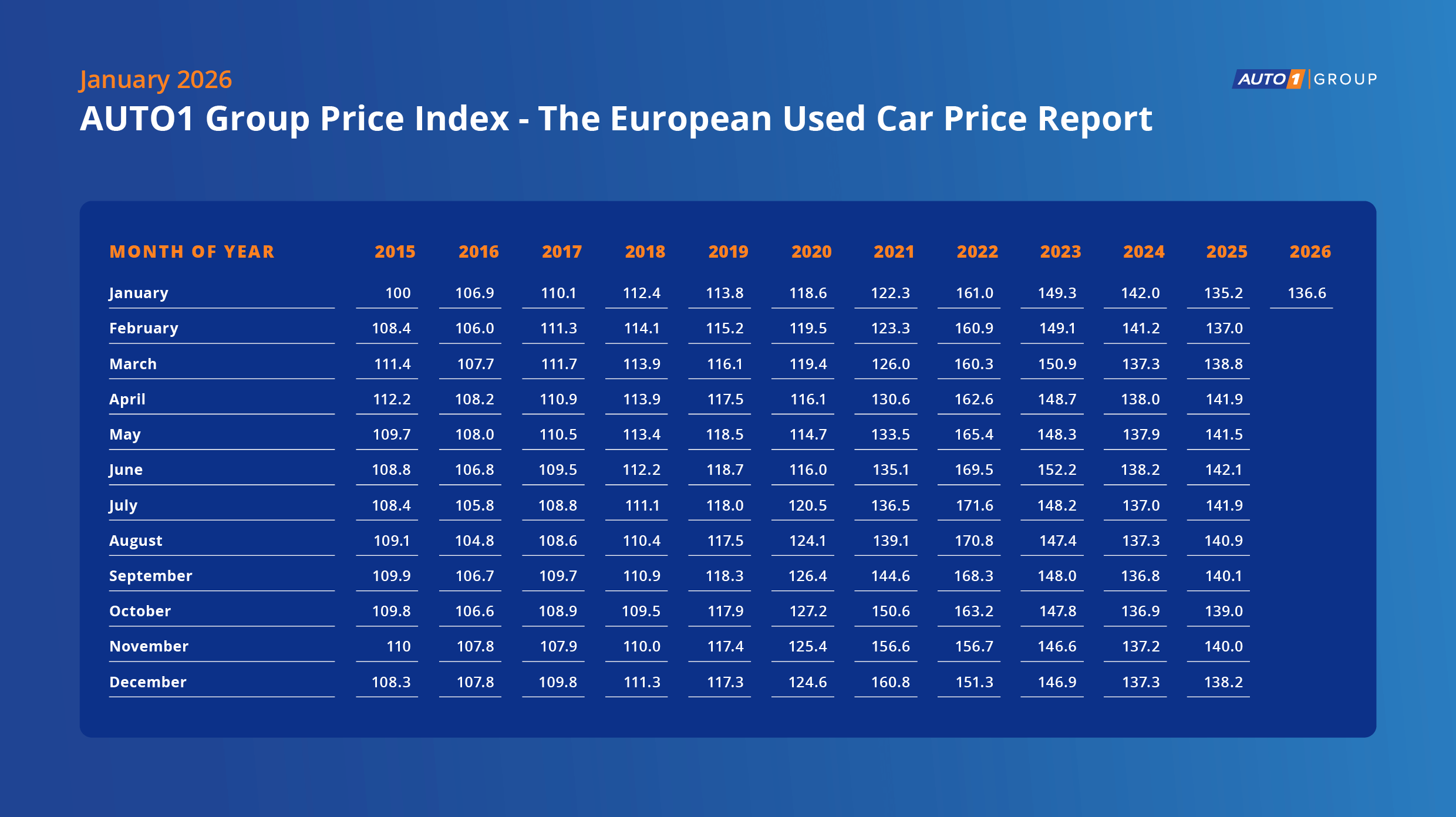

Berlin, 28 January 2026 - The European used car market entered 2026 with a moderate decrease in used car prices, according to the latest The AUTO1 Group Price Index - the European Used Car Price Report. In January, the index recorded a month-over-month decrease of 1.2% in used car prices, with the index moving from 138.2 in December 2025 to 136.6 in January 2026.

Year-over-year, wholesale prices increased slightly by 1%, with the index moving from 135.2 in January 2025 to 136.6 in January of this year.

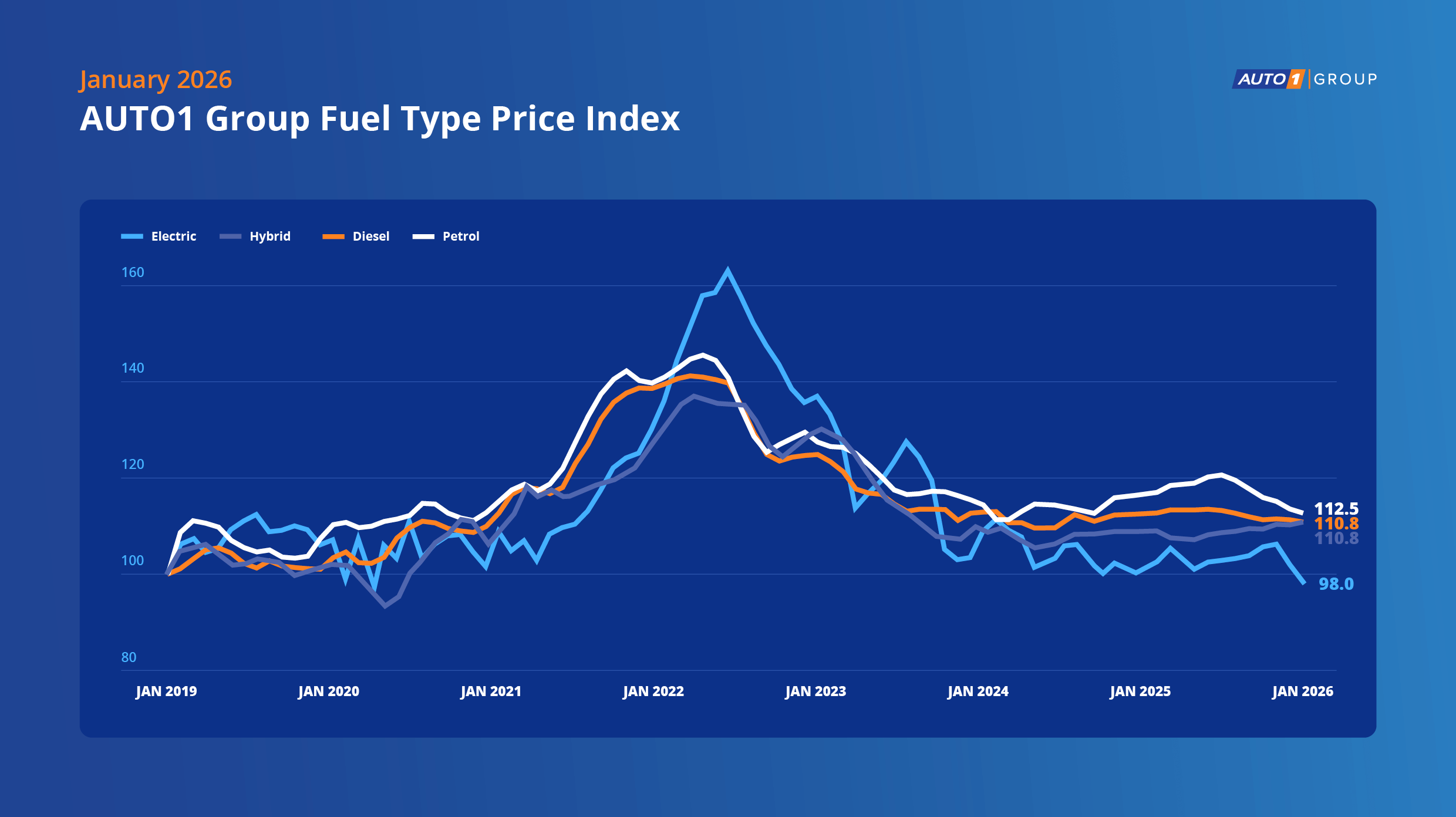

BEV prices drop, hybrid prices rise, combustion engines steady

At the beginning of 2026, the used car market shows divergent price trends across fuel types. While hybrid vehicles had the highest year-on-year price increases, battery electric vehicles (BEVs) experienced the sharpest declines, now trading below their pre-pandemic values and below 100 index points. Meanwhile, prices for petrol and diesel models remained relatively stable compared to previous years.

- • Petrol Cars : After fluctuating throughout 2025, petrol vehicles started 2026 with an index value of 112.5, down 0.8% month-over-month but nearly unchanged year-on-year (+0.2%).

- • Diesel Cars : Diesel prices displayed remarkable stability, opening 2026 with an index value of 110.8, down 0.3% both month-on-month and year-on-year. Diesel remains the most consistent segment in regards to prices in January.

- • Hybrid Cars : Hybrid vehicles entered 2026 with the highest price increase among all fuel types, rising 0.6% month–on-month and 2.2% year-on-year, reaching an index value of 110.8.

- • Battery Electric Vehicles (BEV) : BEVs fell to an index value of 98, now below pre-pandemic levels from January 2019. Prices for BEVs saw the steepest declines, down 4% month-over-month and down 4.4% year-over-year.

Market outlook for 2026: Half of dealers expect further price declines

In line with the AUTO1 Group Price Index trend, results of the latest AUTO1.com survey of European partner dealers* reflect the ongoing downward direction in used car prices since mid-2025. While only a minority (20.4%) of professional car dealers expect used-vehicle prices to rise in 2026, broadly in line with last year’s figure of 21.4%, nearly half (48.6%) of surveyed dealers anticipate prices to decline further in 2026, (compared to 44% last year). Price decreases are particularly anticipated by Polish partner dealers (67.9%), as well as Italian ( 53.5%) and Swedish dealers (53.3%). 31.0% of respondents think that prices will remain stable, compared to 34.6% in the year before.

This marks the third consecutive year in which the majority of surveyed dealers have anticipated either stable or declining prices and the data fully supports these expectations, with the index dropping from 142.0 in January 2024 to 136.6 in January 2026.

"Since mid-2025, we have observed a consistent downward trend in used car prices, a pattern that has continued into the start of this year. This aligns closely with the short-term market sentiment, as many dealers anticipate further price decreases this year. Lower prices are positive news for buyers and we view greater affordability as a continued lever to help stimulate transaction volumes across the market", explains Moritz Lück, SVP Sales & Operations of AUTO1 Group. “This trend is also echoed in Moody’s Analytics’ short-term outlook, which suggests limited growth in used vehicle prices. Looking further ahead, however, Moody’s Analytics baseline forecast** predicts used car prices will rise by 21% by 2036, and nearly double by 2056, driven by consistent input cost and new vehicle price increases and a stable labor market.”

Factors driving pricing trends

When asked about the factors behind current price dynamics, 29.0% of dealers cited consumer demand as the primary driver, followed by changing vehicle preferences (14.2%) while price supporting supply shortages are mentioned less frequently (13.7%). 31.5% mentioned other factors, among which rising new car competition from Chinese automotive brands was highlighted most frequently 25%, especially in Poland, Spain, and Italy. Of those who see Chinese competition as a key influence, 91% anticipate additional price declines. Only 13% referenced new EU emissions or tax regulations, over half (54%) of whom anticipate price drops as a result. In slight support of rising used car prices, high prices of new vehicles are mentioned as a driver, with 11% of dealers mentioning this as a key factor going forward.

*AUTO1.com ran an online survey in December 2025 on its platform with a total audience of 7,182 European partner dealers participating in the survey in its main markets (DE, IT, FR, ES, BE, NL, PL & SE).

** Moody’s Analytics January 2026 Baseline Forecast

About AUTO1 Group

Founded in 2012, AUTO1 Group is Europe’s leading digital automotive platform for buying, selling, and financing used cars. By leveraging technology and data, AUTO1 Group is maximizing value for consumers and partner dealers in Europe across three brands: wirkaufendeinauto.de, Autohero and AUTO1.com. With wirkaufendeinauto.de and its sister brands, the Group offers consumers a fast and easy way to sell their cars. Its Retail brand Autohero makes choosing, buying, and financing high-quality used cars easy and stress-free. AUTO1.com is Europe’s largest wholesale trading platform for car dealers, supporting them in growing their businesses. The company operates in over 30 countries, employed 6,300 people at the end of 2024, generated revenue of EUR 6.3 billion and sold 690,000 cars in 2024. AUTO1 Group went public on the Frankfurt Stock Exchange in February 2021 and is part of the MDAX (Mid-cap German stock market index).For more information please visit www.auto1-group.com or find all press releases in our Press Release section here .

About the AUTO1 Group Price Index - The European Used Car Price Report

The AUTO1 Group Price Index shows the monthly evolution of used car prices across Europe. By analyzing AUTO1 Group’s database of around 5.1 million used car transactions Europe-wide, AUTO1 Group has developed a pioneering index to improve data transparency in the used car market and give insights into wholesale prices. The AUTO1 Fuel Type Price Index shows the wholesale price developments of used cars across various fuel types, including petrol, diesel, hybrid vehicles (PHEV, HEV), and electric vehicles (BEV). The starting point of the AUTO1 Group Price Index is January 2015 with a reference value of 100, whereas the Fuel Type Price Index has a starting point of January 2019. The AUTO1 Group Price Index is published on a monthly basis. Please find the methodology here .

Media Relations Contact

Christine Preyer

Director Communications & PR

Phone: +49 (0)175 64 59 192

Email: press@auto1-group.com

Investor Relations Contact

Maria Shevtsova

Head of Investor Relations

Phone: +49 (0) 170 556 9259

Email: ir@auto1-group.com